Sovereign gold bonds (SGB) are the ultimate gold investment option for people who want to invest in the most profitable platform. In the past 5 years, gold has increased by 100%. This made gold the ultimate investment option. We have other options for gold investment

But why SGB is special than all those options. I have researched to provide the positives and negatives in this investment plan. Sovereign gold bonds are the bonds which given by the government of India and the Reserve Bank of India combinedly. The RBI issues bonds and the Indian government guarantees them. This SGB grants a 2.5% interest on the initially purchased amount of gold, and there is no imposition of tax on the profits gained during the 8 years of lock-in.

What is the use of Govt to issue SGB’s:

SGB are not physical gold and there is no option of converting them into physical gold, so this is the reason behind it. Let’s get into deep, SGB makes a huge impact on countries’ economies and currencies. Before the launch of this, people in India engaged in investments through physical gold options. Here the problem for the nation arises, while a citizen purchases gold in physical format our currency goes out of the country. As known, India does not possess any gold reserves, so every acquisition of gold occurs through the international market. This involves converting the Indian rupee to US dollars, causing a current account deficit for the Central government.This government’s current account deficiency is not a good sign for the country.

To stop this trade exchange in our country Indian government and RBI combined designed the plan SGB. Therefore, it reduces investments in physical gold, transferring them to this. The introduction of this SGB took place in November 2015.

One can check the openings of SGB here.

Let’s see the options for investing in SGB:

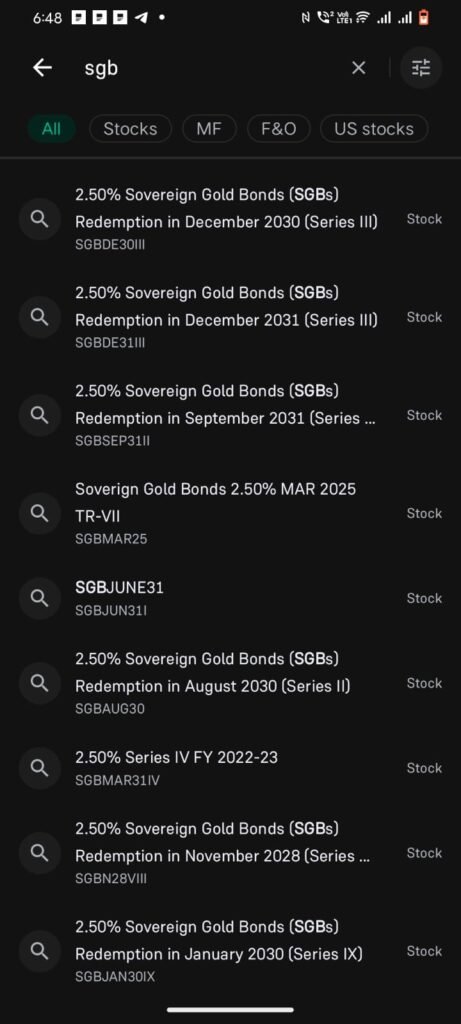

There are two types of SGB investments. One involves RBI issuances on specific days of the year. One can purchase these from banks, post offices, and personal demat accounts. In 2024 Feb 12- to 16 is the subscription period to register for the SGB. Buying through post offices and banks provides you with the physical documentation of SGB. However, buying in demat provides you with a dematerialised format. The best option is the digital form, the lock period is 8 years so better to store it in digital format for that long time.

And other one is through your demat account in the middle of the lock-in period. Any user desiring to sell the SGB within the 8 years is permitted to do through demat accounts, enabling others to buy. However, even if one acquires these SGBs, interest is received in accordance with the policy, but the option for tax redemption is not available.

In the above image we can have multiple SGB’s, I know one gets confused about what to buy. Just focus on the year mentioned on end. The year and month is the date when the maturity or lock-in period of Sovereign gold bond completes. As per your requirement, you can buy any bond with max time to gain interest.

Benefits of SGB:

As we have discussed, SGB has many more benefits when compared with other gold investment options.

Users who wish to sell within 8 years can do so through demat accounts, allowing others to purchase their SGBs. However, even if a purchaser acquires these SGBs, they receive interest according to the policy but do not have the option for tax redemption. The 0 tax is applicable only when you wait till the lock-in period of 8 years.

Let’s calculate the returns and interest we gain, for example, 5Lakhs invested in SGB. Its lock-in period is 8 years. As per the previous year’s reports, gold is increasing by 12% per year. So over 8 years with 12% interest per annum, then we get 7,37,982 rupees. The interest of 2.5% is calculated on 5 Lakhs.

While the same 5 Lakhs invested in other schemes, the profits gained in that investment will be 20% LPCG and 4% CES, but when coming to SGB there will be 0 charges.

Note at this point the 0% tax will be applicable only when the holder keeps the SGB for 8 years.

Negative in SGB:

There is only one big negative in SGB, there will be no buyers when you want to sell in between the lock-in period. The liquidity in SGB is very low when compared to others. When an individual sells in between periods. They are not eligible for tax benefits, and they need to pay Long-Term Capital Gains (LTCG) and Capital Gains Tax (CES). But the interest lies the same till the data one soled.

For more details of issues Sovereign gold bonds, this is the government website.

Get full idea on gold investment.

Future web browser specifications are here with details.

Most of us childhood telecom company was idea or Vodafone, know the journey of VI.

Why BSNL is rising again ? —– The CMF Phone1 Game Changer

Mr Beast chocolate Feastables Facts: The world powerful YouTuber